Georgia 2022 statewide ballot questions explained

What are the questions on this year's statewide ballot?

There are two constitutional questions and two questions about tax exemptions on this year's statewide ballot.

ATLANTA - There are four questions on the statewide ballot. Each impacts Georgia in different ways.

Two of the questions are on constitutional amendments that were passed by the Georgia Legislature, but require passage by voters.

The other two are questions about the granting of statewide property tax exemptions. Both of those were passed by two-thirds supermajority in the Georgia Legislature, signed by the governor, and now must be approved by voters.

Here is a look at what each question means:

Should suspended Georgia officials continue to receive pay?

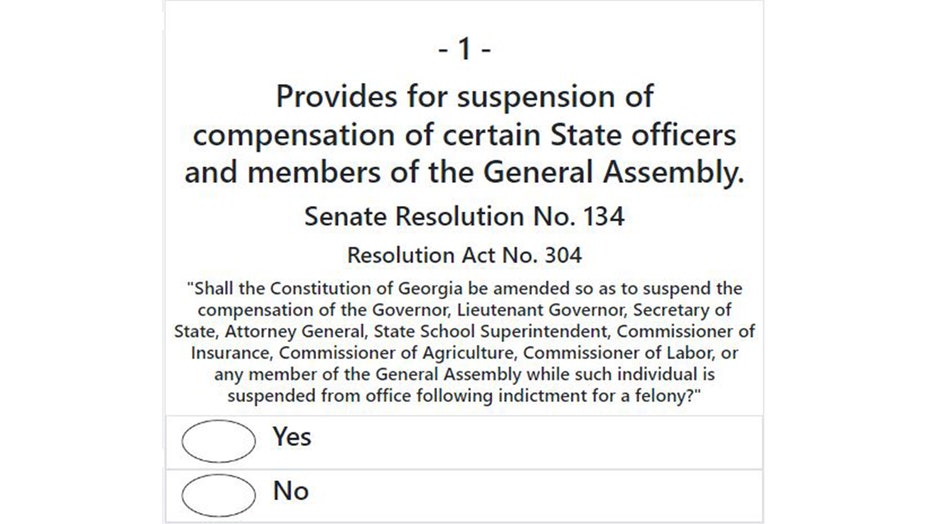

If a Georgia official is suspended, under the state's constitution, they continue to receive pay up until they are found guilty. This proposed amendment seeks to end that practice. It reads:

"Provides for suspension of compensation of certain State officers and members of the General Assembly."

"Shall the Constitution of Georgia be amended so as to suspend the compensation of the Governor, Lieutenant Governor, Secretary of State, Attorney General, State School Superintendent, Commissioner of Insurance, Commissioner of Agriculture, Commissioner of Labor, or any member of the General Assembly while such individual is suspended from office following indictment for a felony?"

The measure actually stems from an ongoing investigation by the FOX 5 I-Team. Georgia Insurance Commissioner Jim Beck was indicted on federal charges of money federal charges of money laundering, mail and wire fraud in May 2019.

Gov. Brian Kemp suspended Beck shortly after, but he continued to draw the nearly $200,000 annual salary for the position. So did Kemp’s appointee to the position, John King, costing the state twice as much.

"They couldn’t suspend him without pay, so this amendment would change that," said Ben Taylor, Associate Professor at Kennesaw State University.

Beck maintained his innocence, but was found guilty and sentenced to seven years in prison in Oct. 2021.

A "YES" vote on this question would mean support to the change the constitution to end salaries for any official suspended due to a felony indictment. Officials who are not convicted and later reinstated, would be entitled to backpay.

"It’s a measure about government accountability. It’s a good government measure. A yes vote would mean that elected officials no longer get paid while they’re suspended for wrong doing, awaiting trial," said Bob Trammell, former Georgia House Democratic leader.

Associated legislation: Senate Resolution No. 134 | Resolution Act No. 304

Should local governments be able to offer tax relief after natural disasters?

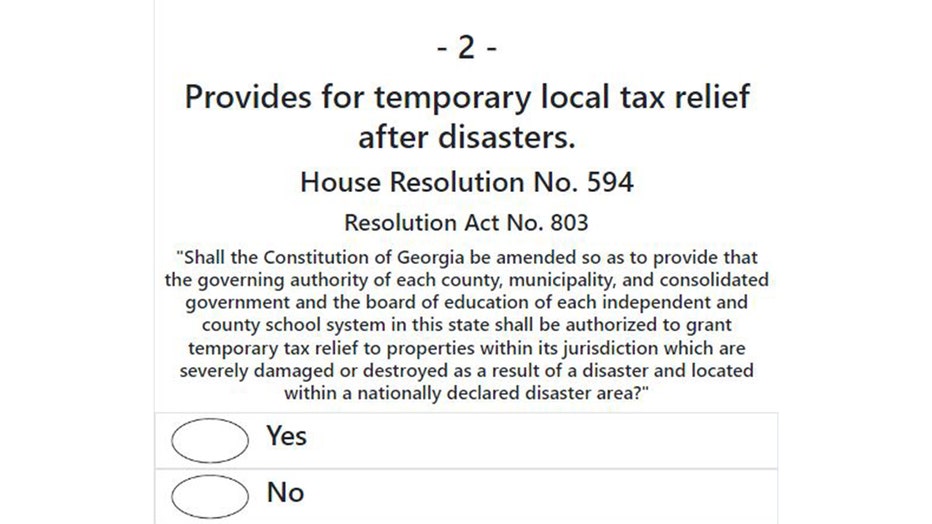

Georgia’s constitution currently does not allow local governments to provide tax relief after a major disaster. This is why the Georgia Legislature, in a rare bipartisan measure, is seeking to change that. The amendment reads:

"Provides for temporary local tax relief after disasters."

"Shall the Constitution of Georgia be amended so as to provide that the governing authority of each county, municipality, and consolidated government and the board of education of each independent and county school system in this state shall be authorized to grant temporary tax relief to properties within its jurisdiction which are severely damaged or destroyed as a result of a disaster and located within a nationally declared disaster area?"

"This specifically came out of the tornadoes in Coweta County that destroyed much of the historic district of Newnan," said Taylor.

On March 26, 2021, an EF-4 tornado tore through Coweta County leaving behind more than $75 million in auto and home insurance claims, according to the Georgia Department of Insurance and Fire Safety. Nearly 1,800 Coweta County homeowners still had to pay taxes on their damaged or destroyed property despite the city of Newnan asking the state to be able to provide relief.

A "YES" vote on this question would grant local governments the authority to provide relief to property taxpayers from having to pay their fully assess property taxes following a tornado, hurricane, or other natural disaster.

Associated legislation: House Resolution No. 594 | Resolution Act No. 803

Should lumber industry equipment be taxed?

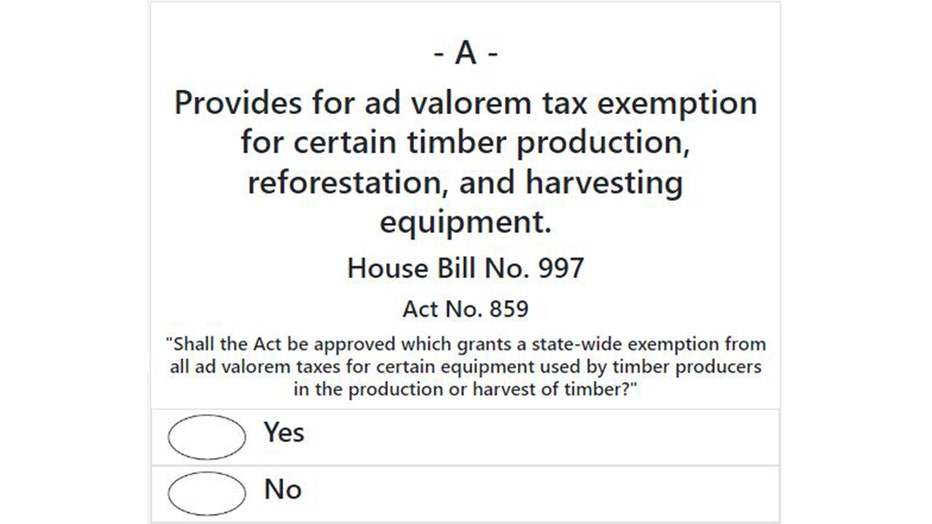

Currently, Georgia taxes all equipment owned or leased that is used in the timber trade. The Georgia Legislature wants to change that. The ballot question reads:

"Provides for ad valorem tax exemption for certain timber production, reforestation, and harvesting equipment."

"Shall the Act be approved which grants a state-wide exemption from all ad valorem taxes for certain equipment used by timber producers in the production or harvest of timber?"

The measure was passed by the Georgia Legislature and signed by the governor, but needs voter approval.

A "YES" vote would allow commercial timber producers to be exempt from paying tax on equipment used for timber harvesting and production. It would include off-road equipment, delimbers, and wood chippers, but not motor vehicles. Timber and subsequent products would still be taxed at fair market value.

Associated legislation: House Bill No. 997 | Act No. 859

Should family farms receive further tax relief?

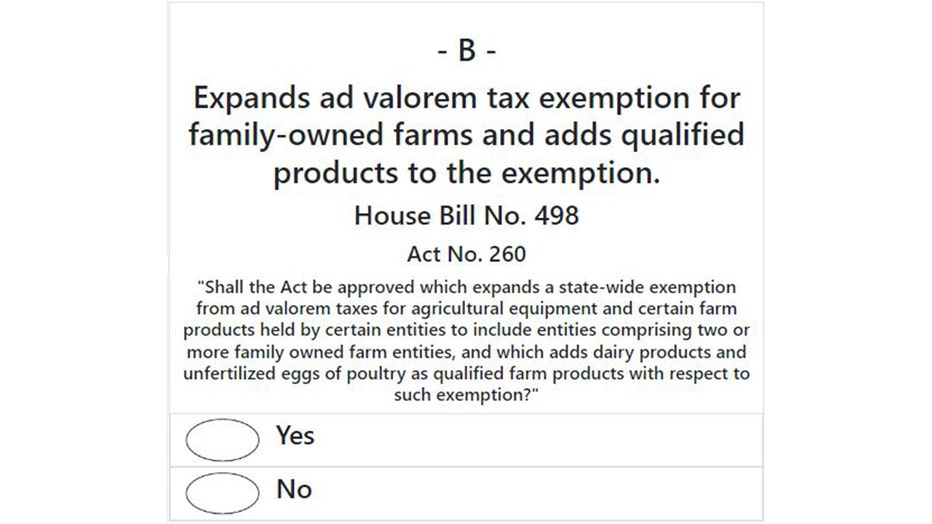

The Georgia Legislature wants to expand tax relief to farming families who produce dairy and egg products and equipment. The ballot question reads:

"Expands ad valorem tax exemption for family-owned farms and adds qualified products to the exemption."

"Shall the Act be approved which expands a state-wide exemption from ad valorem taxes for agricultural equipment and certain farm products held by certain entities to include entities comprising two or more family owned farm entities, and which adds dairy products and unfertilized eggs of poultry as qualified farm products with respect to such exemption?"

The measure passed the Georgia Legislature with near-unanimous support and was already signed by the governor, but needs voter approval before it can pass. It specifically targets family-owned farms.

The economic impact on Georgia’s budget was not immediately known.

A "YES" vote would allow property tax exemptions to be extended to family-owned farms, meaning 80% or more of the income of the property is derived by established agricultural uses, and one or more of the owners are related.

"When they passed the first property tax exemptions years ago when these were first done, these are just areas that for whatever reason, got left out," said Taylor.

Associated legislation: House Bill No. 498 | Act No. 260