Retired Duluth couple loses life savings to phone scammers

Duluth couple loses life savings to scammers

It only took one phone call for a retired Duluth couple to lose thousands of dollars, and they say they didn't even tell the scammers posing as Chase Bank employees any of their personal information.

DULUTH - One phone call. That’s all it took for a Duluth couple to lose their life's savings. And they say they didn’t even tell the scammers anything personal - like passwords or social security numbers.

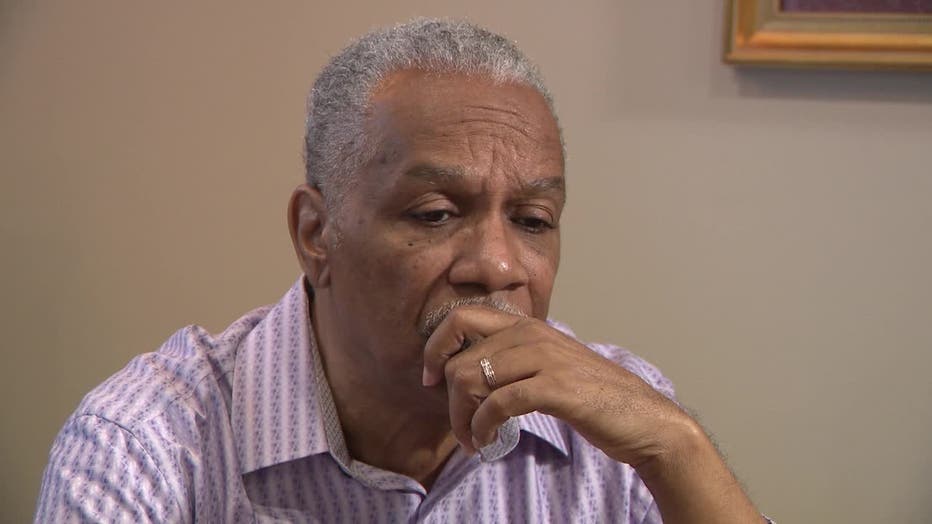

The Mosses have raised their children. Their grandchildren were grown, and they were enjoying retirement. But someone stole their money.

"They took it," Gloria Moss said in her nicely decorated dining room.

The "they" in this case are strangers. Gloria and Gary Moss told the FOX 5 I-Team, local police, and federal fraud investigators that strangers posing as Chase Bank employees took $49,000 from them in less than 30 minutes.

It started in a familiar way; a fraud alert from what they believed to be their bank.

"On Feb. 16, 2024, I received two texts saying they were from Chase’s fraud department," Gloria Moss recalled, "that my husband’s debit card had been compromised."

Here's why she was not alarmed. The scam texts came from the same short code - those six numbers at the top of the text page - as her real Chase Bank communications.

"I know not to click the links, so I called the number," she said.

The phone rep, she said, was professional, reminding her the call would be recorded for training purposes. Moss was told her husband’s debit card number was used at a retailer in other states, totaling more than $4,000. To protect her, they were deactivating the card that they believed had been cloned.

"And next, they said they needed to send a code to verify me to my cellphone," she said.

Gloria Moss

It seemed normal because Chase had sent them potential fraud alerts before when her husband was in California using his card for less than $100 for chocolate-covered strawberries.

"I was trying to send them to surprise her," Gary Moss said. "And they called her to verify this was not fraud."

A surprise spoiled, but they were OK with that. They loved the protection. But the next big surprise from the bank, they can’t live with. Scammers drained them of their entire savings: $49,000.

Gary Moss

Let’s go back to the phone call that started it.

The I-Team's Dana Fowle asked Moss if she gave up her social security number, her account number, her passwords, or maybe her security code answer. She responded "No" each time.

They said they were deactivating her card and issuing a new one.

"I literally was on the phone with them one time, for a good 20 minutes, I believe," she said. "She would put me on hold, but evidently, what they were doing was cleaning out the account."

It was later that afternoon that the couple realized they'd been scammed.

"I had received five emails from who I thought was Chase. But, according to Chase, it was not them," Gloria Moss said.

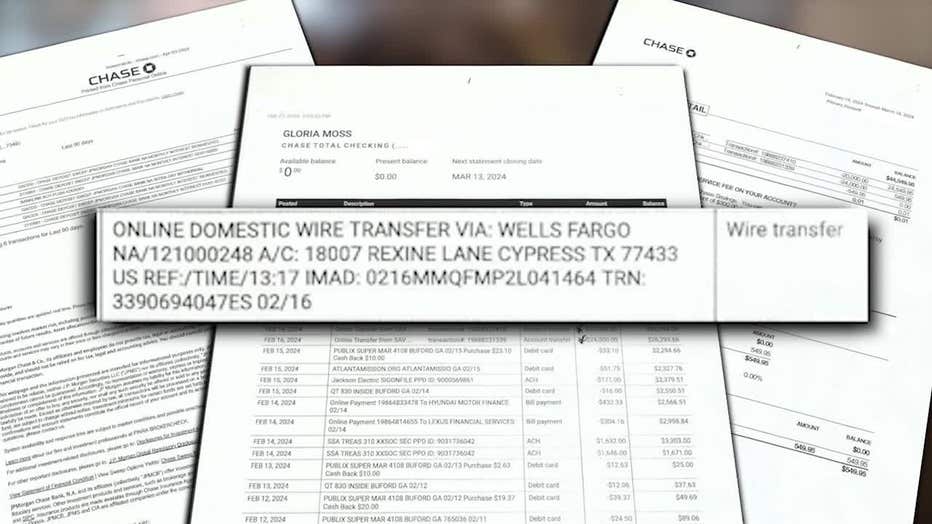

The couple's money was sent via a wire transfer to a stranger's Wells Fargo account. Wells Fargo, the retirees told us, was able to return more than $700 to the Mosses.

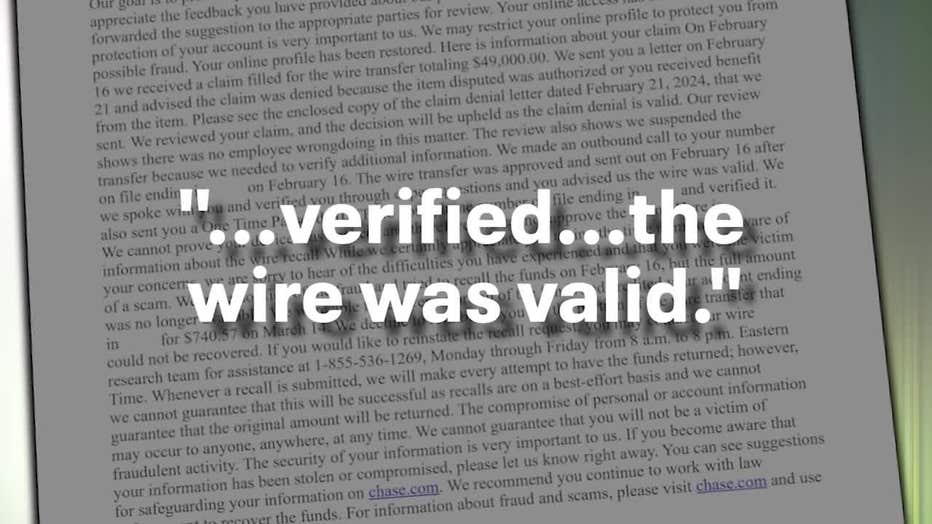

In a letter sent in February, Chase Bank told the couple it "will not reimburse your account." The bank told the Consumer Financial Protection Bureau in mid-April that they called the Mosses's number on file and that someone on the other end of that line "verified" ... "the wire was valid."

Gloria Moss said after months of chatting with a Chase representative, this April development was news to her.

"This is the first time we are hearing any of this," she said.

How all of this happened is still unclear. Chase in an email to the I-Team warned about "spoof" call scams.

"Remember," the email read, that "even if your caller ID says a call or text is from Chase, it could be a scam. When in doubt, hang up and call us directly."

After months of trying to manage this fraud on their own, the Gwinnett Police Department has opened an investigation looking into how someone accessed their cell phone.

"People need to be aware," Gloria Moss concluded.

She told the I-Team that if she could show that her phone was hacked, the Chase representative assigned to her said that they would look at her case again. Chase would not comment on that. The I-Team will keep looking into their case.