Home buyers backing out of contracts as rates rise

Home buyers backing out of deals

Gone are the early-pandemic days when putting up a for sale sign would mean 10 offers right away. Now home sales are getting cancelled at record numbers.

ATLANTA - The deal Is off! If you are trying to buy or sell a home, those are four words you don't want to hear. But last month alone, it happened 60,000 times nationwide, and it’s happening in Atlanta as well.

Just earlier this year, FOX 5 real estate expert John Adams was talking about sellers putting up a for sale sign and getting maybe 10 offers for full price or even above. Now things have changed. Home sales are getting canceled at the highest rate since the start of the COVID-19 pandemic

What changed is that inflation hit a 40-year high. We stumbled into an economic recession, and so Adams says the Federal Reserve has declared war on the housing industry.

Since November of last year, home mortgage interest rates have increased dramatically from 2.98% to an average rate today of just under 5.50%. That is a staggering increase, and it was caused primarily by the Jerome Powell and the Federal Reserve desperately trying to slow down the economy and cool off inflation.

A "sale pending" sign is displayed in front of a home for sale in San Rafael, California. (Photo by Justin Sullivan/Getty Images)

Whether or not the artificial intervention of the Fed will slow inflation remains to be seen, but every time the interest rate rises by even a fraction of a percent, more and more prospective home buyers are no longer able to qualify for a home loan.

Economists claim that since November 2021 at least 4 million buyers have been pushed out of the buying market. That’s a lot of buyers.

Adams says are two primary factors driving the trend of buyers backing out of contracts.

First, the slowdown in housing-market competition is giving homebuyers room to negotiate. Buyers are increasingly keeping rather than waiving inspection, appraisal, and financing contingencies. That gives them the flexibility to call the deal off if issues arise during the homebuying process.

This is in direct contrast to as recently as earlier this year, when competition was so fierce that buyers were advised to waive all contingencies if they hoped to even be considered as a prospective buyer.

Second, rising interest rates are also forcing some buyers to cancel home purchases. If rates were at 4% when you made an offer, but reached 5.5% by the time the deal was set to close, you may no longer qualify for a loan due to the higher monthly payments.

The Mortgage Banks Association recently reported that interest rate increases have forced upwards of 4 million prospective buyers out of the home-buying market since just January of this year. That is a huge shift.

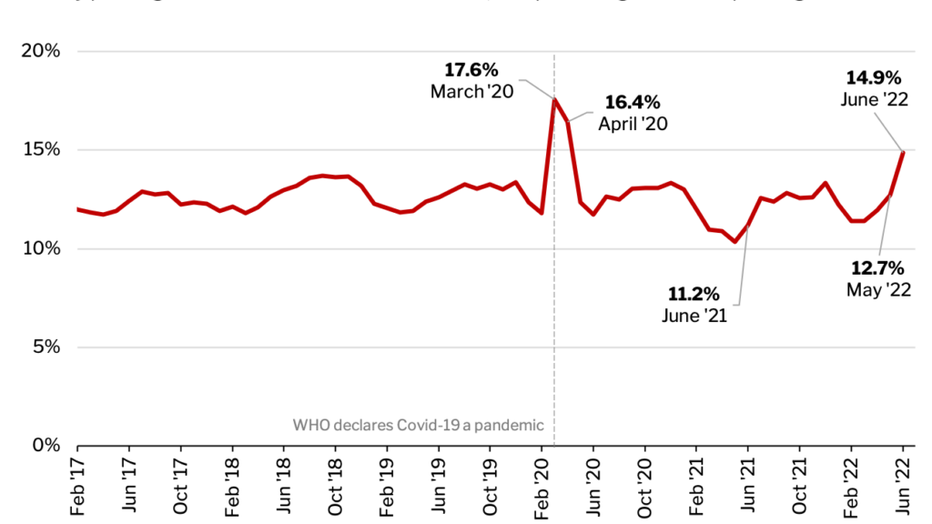

Buyers aren't just canceling contracts in Atlanta, they are doing so in record numbers. During the month of June, the U.S. contract failure rate was about 14%. But here in metro Atlanta, we saw contracts fall apart at a might higher rate of 22%, and Adams can’t tell you why.

His hope is that inflation will subside and that our government will stop printing money it does not have. Everytime the Treasury prints another sheet of cash, it makes the value of each dollar worth a little bit less.

The bottom line is what we are seeing is the pain the housing industry must endure in order for things to get back to a normal rate of home appreciation. Since January 2020, home values nationwide have climbed on average 32.9%, and that is simply unsustainable.

No, Adams does not expect a housing crash, but yes, he does expect the market to slow substantially between now and early next year.