Debt ceiling: Experts worry US default could send economy into tailspin

Impact of potential US default

Experts worry that if an agreement on the debt ceiling can't be reached by the June 1 deadline, the US default could send the economy into a tailspin.

The June 1 deadline to raise the debt ceiling is fast approaching and right now the White House and Republicans in Congress are at odds over whether to increase the nation’s spending limit.

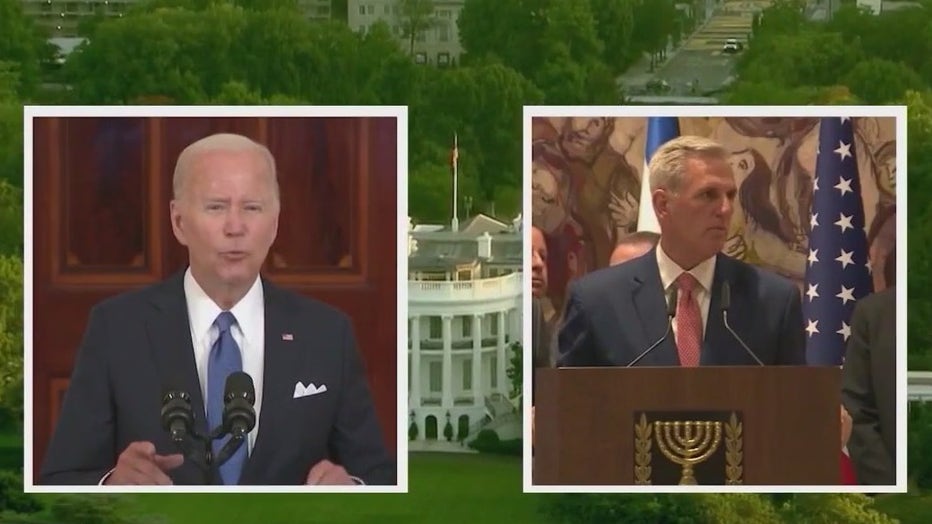

Debt ceiling negotiations are locked on a classic problem that has divided and disrupted Washington before: Republicans, led by House Speaker Kevin McCarthy, want to roll back federal government spending, while President Joe Biden and other Democrats do not.

The U.S. already hit the $31.4-trillion ceiling. The government needs to borrow more money to pay its bills. Treasury Secretary Janet Yellen has said that "it seems almost certain" that the United States would not make it past early June without defaulting. That would be catastrophic, as the government risks running out of cash to pay its bills as soon as June 1.

Some experts caution defaulting could send financial markets into tailspin. Government employees could go unpaid. Businesses and the average Georgian could have a tough time borrowing money. Some experts worry all that could deal a blow to the economy.

Kevin Crowley, a finance professor at Emory’s Goizueta Business School, believes the economic impact would hurt, but the pain could be short-lived.

"There could be a very sharp, violent reaction but that would focus people’s attention, and they would get back to the table and find a way to make it right," Crowley said. "Neither party, Democrats nor Republicans would come out looking good, so they would ultimately get together and do the right thing.

Breaking down the debt ceiling debate

If Congress can't agree on something, the U.S. may be in jeopardy of falling short on paying its bill next month. The FOX 5 I-Team's Dana Fowle explains everything you need to know about the contentious issue Washington, D.C. is facing.

"Armageddon and sky-high interest rates, I doubt that will be the ultimate result. It would be reckless to choose not to pay what we owe," Crowley said.

Anxious retirees and social service groups are among those making default contingency plans.

The Associated Press contributed to this report.