Majority of renters worry about never being able to buy their own home

More than half of renters worry they'll never buy a home

Owning a home has always been a part of the American Dream, but more than half of working-age renters worry they won't be able to buy one in their lifetimes.

ATLANTA - Owning a home has always been a major part of the American Dream. But rising home prices have made homeownership even harder to attain — and a significant percentage of today’s renters worry that they will never be able to afford their own home.

Because homeownership has long been a touchstone of success and financial security in the U.S., so it should be no surprise that 88% of consumers would rather own a home than rent.

But more than half of working-age renters worry they won’t be able to buy a home during their lifetimes, according to a new Lending Tree survey.

That concern is largest among renters in Generation X (41 to 55 years old) and millennials (25 to 40 years old). A full 55% of Gen X renters and 52% of Millennial renters are worried about their prospects of homeownership, according to the survey, which was published Aug. 31.

(Image by JayMantri from Pixabay)

These renters are in the midst of their careers, especially Gen Xers in their peak earning years, and they are thinking, "If I haven’t bought a house by now, is it ever going to happen?"

And owning your own home tends to create financial stability and long-term wealth that benefits not only the family of the owner but the community as well. For example, owners pay property taxes, which funds schools, hospitals, public safety, and all levels of government services.

It is hard to believe, but it is true. The average net worth of a homeowner is 40 times that of the average renter, and the gap is widening.

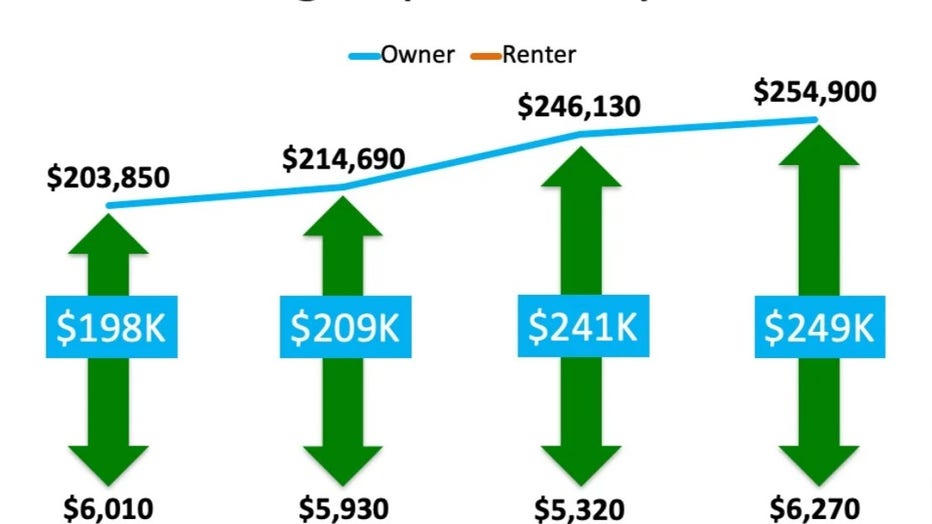

The above chart from The Federal Reserve Board’s triennial Survey of Consumer Finances (SCF) shows renter net worth stuck around $6,300, while owner net worth climbs ever higher.

And because the next survey will not be performed again until 2022, these numbers do not reflect the dramatic price gains made in the past 18 months, in some cases, well in excess of 20%.

In other words, the gap between renters and homeowners is getting larger, not smaller. That’s not good for America, and it’s certainly not good for renters.

But if a renter feels like they can never buy, here are five quick ideas they can do:

1. Talk to a lender - review your credit report,

2. Begin saving money - look for unlikely sources,

3. Explore rent to own and learn about sweat equity,

4. Learn about Home Buying at NACA.com or HUD.com,

5. Never give up!

If you are a renter and enjoy the freedom and lower cost of renting, you might want to reconsider your long-term plans in light of likely financial outcomes.

But if you are between 21 and 55, and hope one day to own a home, FOX 5 real estate expert John Adams strongly urges you to find a way to move in the direction of your goal.

WATCH: FOX 5 Atlanta live news coverage

_____

Sign up for FOX 5 email alerts

Download the FOX 5 Atlanta app for breaking news and weather alerts.