Georgia special tax refund payments | What you need to know

ATLANTA - Georgians will soon have a little extra money put back in their wallets.

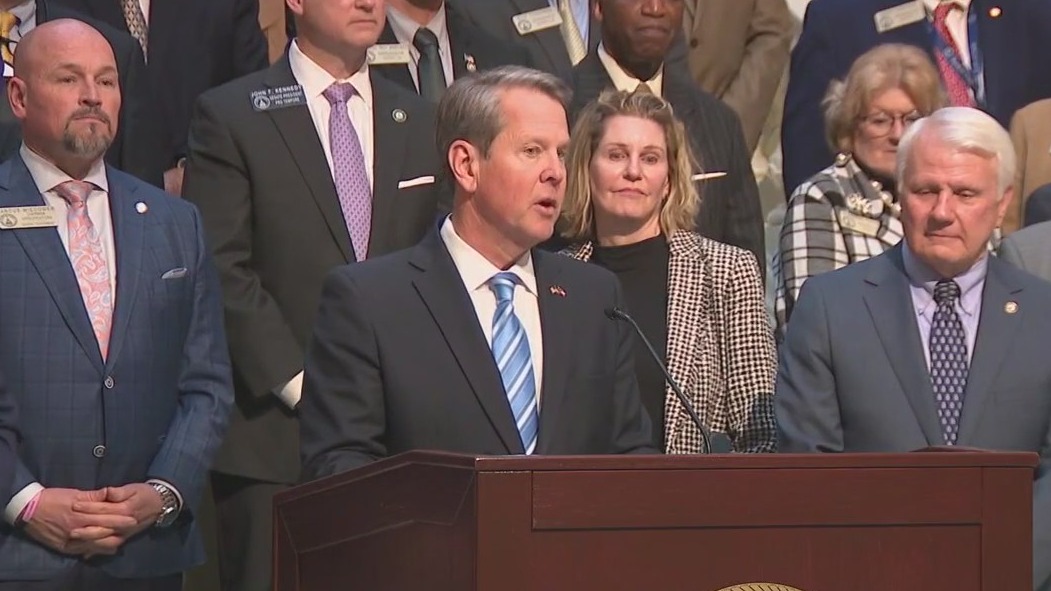

Gov. Brian Kemp on Monday signed HB 162 into law, which gives a special state income tax refund back to Georgia taxpayers for the second year in a row. The special refund was accounted for in the amended 2023 fiscal year budget, which was signed by Kemp on March 10. As a result, there's over $1 billion in surplus funds on its way back to taxpayers.

Kemp signs new state budget

Surrounded by state lawmakers, Gov. Brian Kemp held a press conference at the State Capitol highlighting the changes to this year's state budget. It includes about $2 billion in payments expected to go back to Georgia taxpayers.

Who is eligible to receive a special state income tax refund?

Georgia taxpayers who filed returns in both the 2021 and 2022 taxable years are eligible for the refunds. That means you lived and worked in the State of Georgia for both tax years. if you only lived and worked in the state for one of those years, unfortunately you are not eligible for the special refund.

Here's how much you can expect to receive based on your filing status:

- Single tax filers and married individuals who file separately could receive a maximum refund of $250

- Head of household filers could receive a maximum refund of $375

- Married individuals who file joint returns could receive a maximum refund of $500, based on an individual or couple’s tax liability

When can I expect my Georgia special income tax refund?

According to a news release from Kemp's office, the Department of Revenue will begin issuing the funds within six to eight weeks. For those who file their taxes on or before April 18, the DOR is expected to issue the overwhelming majority of refunds by July 1, 2023.

The governor's office says taxpayers will also have the ability to check the status of this special tax refund via an additional tool on the DOR website, which is expected to launch in six to eight weeks.