Seeing another surplus, Kemp still ready to spend in budget

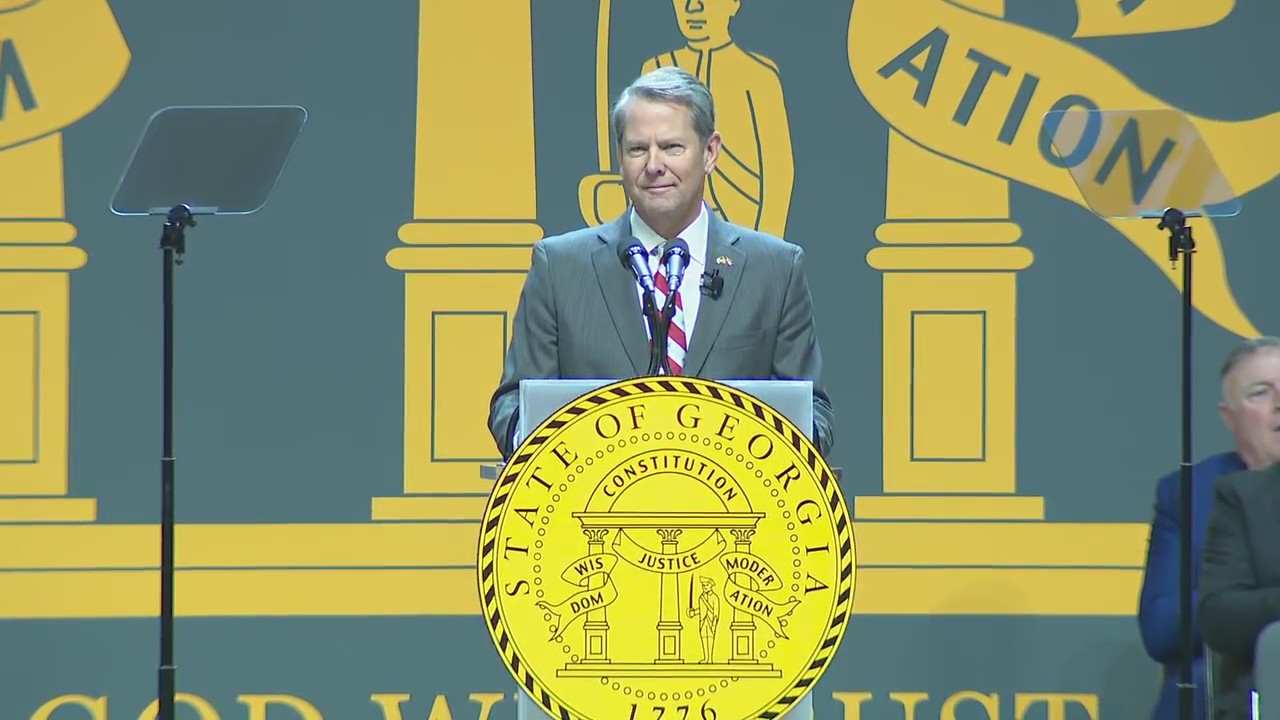

Gov. Brian Kemp's full inaugural address

Georgia Gov. Brian Kemp called for pay raises for teachers and state and university employees as highlighted the state's job growth focused on the manufacturing of electric vehicles.

ATLANTA - Pay raises and tax refunds mean Georgia’s era of big spending is not over.

Gov. Brian Kemp, in budgets released Friday, proposed increasing spending in the current budget year by $2.4 billion, largely to pay for two billion-dollar tax givebacks, and then to maintain spending in next year’s budget, funding $2,000 pay increases for all state and university employees and public school teachers.

Kemp would also end the two-tier system of HOPE Scholarships starting next fall, paying full college tuition for every high school graduate with a B average instead. Since 2011, when Gov. Nathan Deal and lawmakers cut the lottery-funded program, only high school graduates with a 3.7 grade point average and high test scores qualify for full tuition. Regular HOPE recipients get 90% of tuition. Kemp said restoring full eligibility would cost $61 million more in lottery proceeds, saving the average student $444 a year.

Gov. Kemp delivers victory speech

Gov. Brian Kemp delivers his victory speech after winning the 2022 race for Georgia governor, securing another term in office. He lays out future plans for Georgia's economy.

Georgia saw state revenues spike to $36.6 billion in the year ending June 30, driven by a surging economy propped up by a bonanza of federal COVID-19 relief. Revenues had originally been projected to fall back to $30.2 billion this year. But through December, the halfway point of the 2023 budget year, tax receipts are running nearly $1 billion above that projection, according to numbers released Friday.

The state now projects it will collect $32.6 billion this year, a surplus of $2.4 billion. That will include fuel tax collections, which resumed Wednesday after being suspended since March. They’re likely to add another $170 million a month.

The projected surplus would add to $6.6 billion in spare cash that Georgia already has, even after filling its savings account to the legal limit. The revenue growth means Kemp won’t have to dip into that spare cash to fund another $1 billion round of state income tax rebates, which would give taxpayers between $250 and $500 back. The surplus also wouldn’t be needed to pay for a $1.1 billion property tax rebate for homeowners, which Kemp says would give the typical homeowner about $500.

"These actions will put real money back in the pockets of hardworking Georgians facing unforeseen jumps in property values and record-high inflation," Kemp wrote in a letter introducing his budget.

The governor does propose using $1.1 billion of the $6.6 billion to refill roadbuilding funds making up for fuel taxes Georgia didn’t collect in the first six months of the budget year. But more than $5 billion could be left.

Lawmakers will spend the next months writing budgets, but a governor’s proposals are influential in Georgia. Kemp, by law, sets the maximum amount of money lawmakers can spend.

Kemp wants lawmakers to amend this year’s budget to include lots more one-time spending. He would give new $50,000 safety grants to every public school, totaling $115.7 million, after giving an earlier $90 million round of grants. He’d also spend $25 million on one-time grants to offset learning loss and $15 million to encourage classroom aides to become teachers.

The state’s largest teachers group, the Professional Association of Georgia Educators, lauded the move, saying many teachers hold second jobs or leave the profession because of low pay.

"There is no doubt that a salary increase would assist with recruitment and retention of excellent educators for Georgia’s children," PAGE Executive Director Craig Harper said in a statement.

Kemp would spend $52 million to start a much-disputed program providing Medicaid to some poor adults who meet work or education requirements. He’d spend $27 million to add school counselors, finally fulfilling a promise lawmakers made in 2013. and he’d spend $25.6 million to open a new prison.

There would be some big spending increases in 2024 just to maintain current services. Kemp is seeking $312 more million to pay for higher Medicaid costs, as the federal government reduces the share it pays for the health insurance program. Spending on employee health benefits would rise $423 million in the current budget and $1 billion in 2024 to cover increased health plan costs.