Mortgage refinance rates plummet amid fee ending: How to lock in your rate now

Mortgage interest rates fell to all-time lows across all refinancing products after the FHFA announced it would eliminate a 0.5 percent lender fee earlier than expected. (iStock)

Mortgage refinance rates fell to record lows this week following the elimination of the Adverse Market Refinance Fee, effective August 1.

The Federal Housing Finance Agency (FHFA) implemented this 0.5% lender fee on Fannie Mae and Freddie Mac home loans in December 2020 as a way to prevent losses caused by the COVID-19 pandemic, including mortgage forbearance. But the agency announced on Monday that it decided to eliminate this fee earlier than planned as a way to help homeowners take advantage of historically low mortgage rates.

Mortgage refi loans that are originated now will not be subject to the fee, since these wouldn't close until after Aug. 1. As a result, we're already seeing mortgage lenders pass on the cost savings to borrowers in the form of lower mortgage rates.

Don't miss out on record-low mortgage rates. Lock in your rate today by getting preapproved for mortgage refinancing on Credible's online loan marketplace. Doing so will not affect your credit.

SHOULD I GET A FIXED-RATE OR ADJUSTABLE-RATE MORTGAGE?

Mortgage refi rates tumbled to all-time lows again

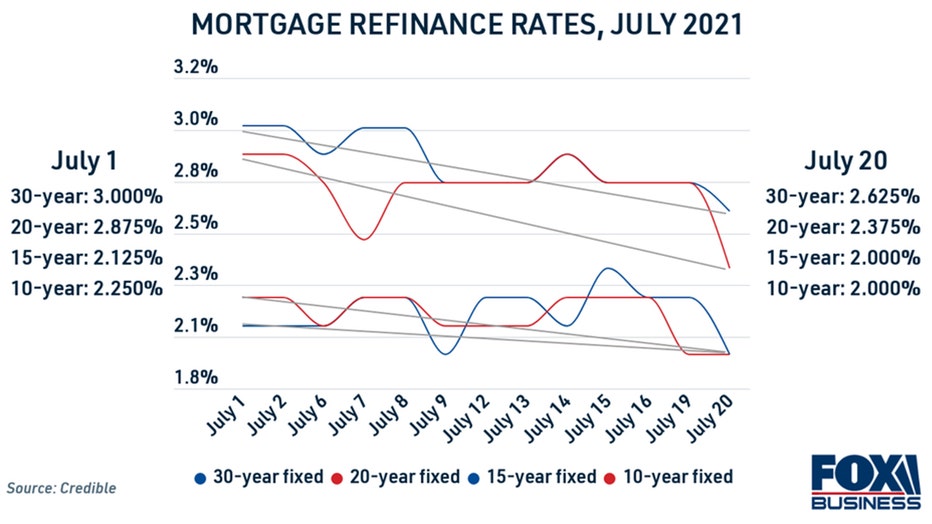

Rates fell for mortgage loans of all lengths immediately following the FHFA's announcement that it would eliminate the Adverse Market Refinance Fee. Here are current refinance rates as of July 20, according to data from Credible:

- 30-year mortgage refinance: 2.625%

- 20-year mortgage refinance: 2.375%

- 15-year mortgage refinance: 2.000%

- 10-year mortgage refinance: 2.000%

WHAT ARE MORTGAGE DISCOUNT POINTS — AND HOW DO THEY WORK?

Rates on 30-year mortgage loans are the lowest they've ever been, matching the same record rate that was set in January of this year, according to the Credible data.

20-year refinance rates hit an all-time low of 2.375%, which is particularly advantageous for new homeowners. By refinancing to a shorter loan term, you may be able to keep your monthly payments the same while shaving years off your mortgage. Paying off your home loan faster can save you tens of thousands of dollars over the life of the loan.

Mortgage refinancing can also help you lower your mortgage payment, so you can reduce your monthly housing costs. See current mortgage rates from real lenders in the table below, including the annual percentage rate (APR). When you're ready to begin your mortgage refinance, visit Credible to estimate your new mortgage rate without a hard credit inquiry.

WHAT YOU NEED TO KNOW BEFORE MAKING A DOWN PAYMENT ON YOUR HOME

How to lock in your historically low mortgage rate

Act swiftly to lock in a good interest rate while mortgage rates are at record lows. Here's how:

- Check your credit score. The minimum credit score needed to refinance is around 620, but the lowest possible rates are reserved for well-qualified borrowers with scores of 720 or higher.

- Determine your loan-to-value ratio (LTV). You can calculate your LTV ratio by dividing your current mortgage balance (loan amount) by the current value of your home. The maximum LTV on a conventional refinance is 95%.

- Get prequalified through multiple lenders. This allows you to check your potential interest rate without impacting your credit score. Compare the offers by monthly mortgage payment, term of the loan and interest rate to determine which lender is right for you.

- Formally apply for the mortgage refinance loan. The lender will want to verify your income and identity, so they'll conduct a hard credit check. You'll also have to get your home appraised before you close on the loan.

You can check your estimated mortgage interest rate across multiple lenders by filling out a single form on Credible. This ensures you can lock in the lowest possible rate for your unique situation.

WHAT IS PRIVATE MORTGAGE INSURANCE (PMI) AND HOW DOES IT WORK?

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.