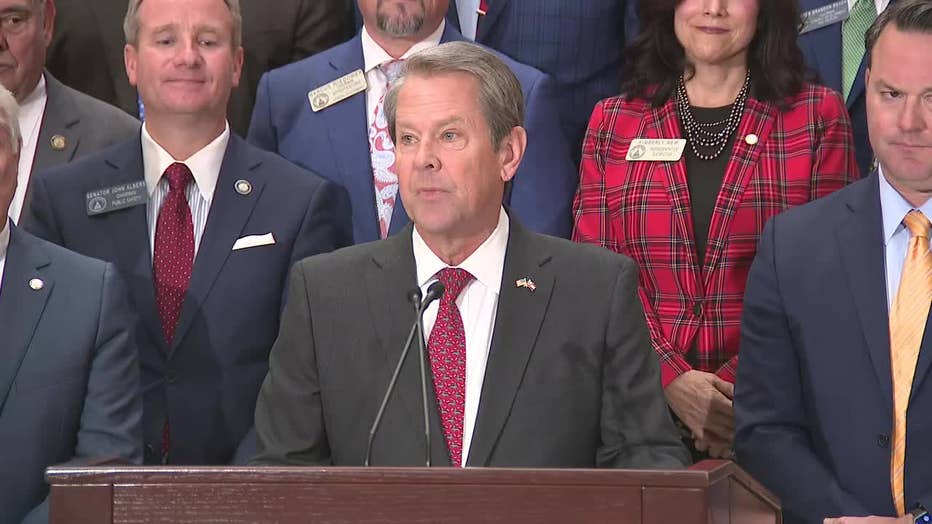

Kemp, lawmakers announce plan to 'accelerate' Georgia income tax cut

ATLANTA - Gov. Brian Kemp announced Monday that he will introduce new legislation to "accelerate" what he says will be the largest income tax cut in Georgia history.

At the Georgia Capital, Kemp was joined by first lady Marty Kemp, Lt. Gov. Burt Jones, Speaker Jon Burns, and state lawmakers to announce plans to pass an amendment to HB 1437.

The current bill would provide a step-down of 10 basis points to Georgia's income tax rate starting in 2025. The decrease would continue every taxable year until the rate reached 4.99%.

Officials say the acceleration would leave the rate for Tax Year 2024 at 5.39% - 0.1% less than what was set by HB 1437.

"When I signed the largest income tax cut in state history in 2022, I did so with the understanding we would deliver on this promise in a responsible way," Kemp said in a statement. "Now, thanks to our conservative budgeting and strong state economy built on business-friendly policies, we are well-positioned to move the timeline up and put more money where it belongs -- back into Georgians' pockets. I look forward to working with our partners in the legislature to bring this further relief to families still burdened by Bidenomics."

The Office of Planning and Budget estimates the legislation would save Georgia taxpayers around $1.1 billion in 2024.

In October, the State Accounting Office said that Georgia ran a $5.3 billion surplus in the 2022 budget year ended June 30, even after spending $32.6 billion.

Total state general fund receipts rose about $1 billion, or 3%. But because Gov. Brian Kemp has kept budgeting spending well below prior year revenues, the amount of surplus cash at the end of each year keeps rising.

The state has other reserves, as well, including a rainy day fund filled to the legal limit of $5.4 billion and a lottery reserve fund that now tops $2.1 billion. All told, Georgia had about $18.5 billion in cash reserves by June 30, an amount equal to more than half of projected state spending for the current budget year.

The Associated Press contributed to this report.