Gov. Kemp signs income tax cuts into law for residents, businesses

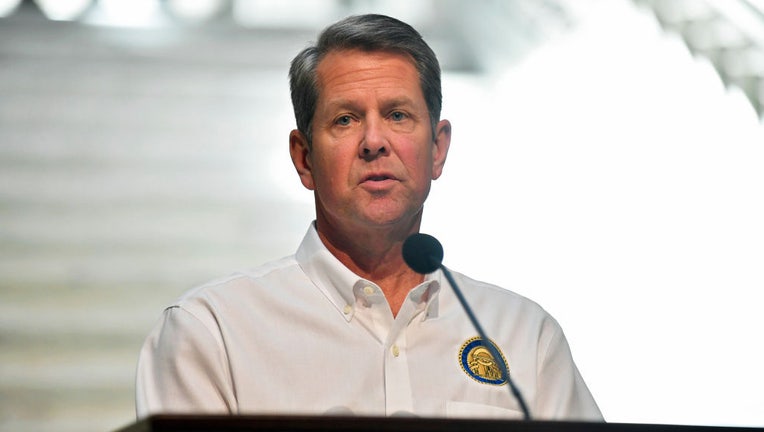

Georgia Gov. Brian Kemp speaks to members of the media at the Georgia State Capitol on May 07, 2020, in Atlanta. (Photo by Austin McAfee/Icon Sportswire via Getty Images)

ATLANTA - Georgians can expect tax relief as Gov. Brian Kemp signs a series of tax bills into law aimed at reducing the burden on taxpayers across the state.

Under House Bill 1015, the state income tax rate will decrease from 5.49% to 5.39%. Gov. Kemp expressed his intention to further reduce the tax rate to 5% in the future.

Another significant measure includes a reduction in the income tax rate for corporations to match the rates applied to individual taxpayers. The new laws will save Georgia residents and businesses about $500 million in income taxes next year.

Kemp also signed House Bill 1021, which will raise the state's child tax credit from $3,000 to $4,000 for each dependent.

And he signed Senate Bill 496, which extends the expiration dates of two state tax credits designed to promote the rehabilitation of historic homes.

All five bills received overwhelming support from the legislature's Republicans, as well as the majority of Democrats, highlighting bipartisan agreement on the importance of providing tax relief to Georgians.